ค้นพบแบรนด์และเทคโนโลยีจากหน่วยธุรกิจของเรา เทคโนโลยีกาวเฮงเค็ล (Henkel Adhesive Technologies) และ แบรนด์ผู้บริโภคของเฮงเค็ล (Henkel Consumer Brands)

15 ส.ค. 2565 Düsseldorf / Germany

Henkel significantly increases sales, drives strategic agenda and raises sales guidance for 2022

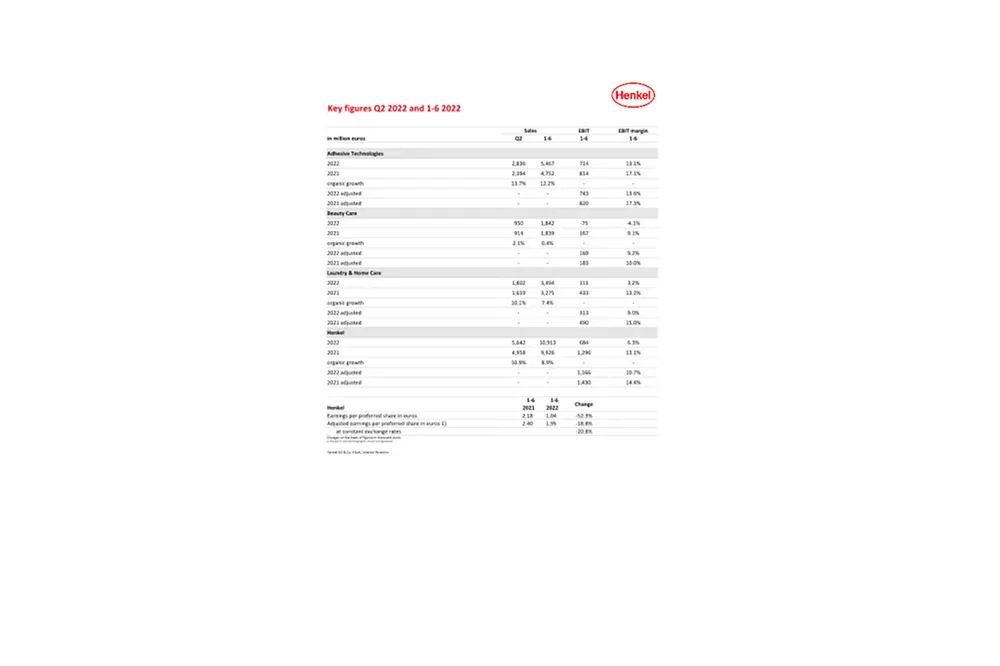

- Group sales in the first half of 2022 grew organically by +8.9 percent to around 10.9 billion euros (nominal +9.9 percent), driven by all business units and regions

- Earnings impacted, as expected, by drastic input cost headwinds:

- Operating profit (EBIT)* reaches 1,166 million euros (-18.5%)

- EBIT margin* at 10.7% (-370 basis points)

- Earnings per preferred share (EPS)* at 1.95 euros, -20.8% at constant exchange rates

- Good progress in implementing the purposeful growth agenda and in merging the consumer businesses into Henkel Consumer Brands

- Outlook for fiscal 2022 updated:

- Organic sales growth: increased to +4.5 to +6.5 percent

- EBIT margin*: unchanged at 9.0 to 11.0 percent

- Earnings per preferred share (EPS)* at constant exchange rates: unchanged a decline in the range of -35 to -15 percent

In the first half of 2022, Henkel increased Group sales to around 10.9 billion euros. This corresponds to significant organic sales growth of +8.9 percent. This positive development was driven by all business units and regions. As expected, the earnings in the first half of the year were impacted by the drastic rise in material and logistics prices. Despite significant price increases, strict cost management and further efficiency improvements these effects could not fully be compensated.

“In a very challenging environment, sales performance in the first six months exceeded the previous expectations for the full year, while earnings developed in line with our Group guidance for fiscal 2022. In view of this development, we have raised our full-year guidance for organic sales growth for the Group and confirmed our guidance for the EBIT margin and earnings per preferred share”, said Henkel CEO Carsten Knobel.

“We are consistently advancing our strategy for purposeful growth and made good progress in implementation in the first half of 2022 – thanks above all to the strong commitment of our employees worldwide. With our Adhesive Technologies business, we are a global leader in providing innovative solutions, focusing on future trends such as mobility, connectivity and sustainability. By combining the Laundry & Home Care and Beauty Care consumer businesses, we are now creating a multicategory platform with sales of around 10 billion euros. We are well on track and aim to have our future Consumer Brands business established latest by the beginning of 2023. The combined unit will offer a broader base to optimize our portfolio more consistently and will advance the business to a higher growth and margin profile.”

Outlook for fiscal 2022 updated

Henkel now expects organic sales growth of +4.5 to +6.5 percent in fiscal 2022 (previously: +3.5 to +5.5 percent). Organic sales growth of +8.0 to +10.0 percent is still expected for the Adhesive Technologies business unit. For Beauty Care, Henkel now anticipates organic sales growth of -3.0 to -1.0 percent (previously: -5.0 to -3.0 percent). For the Laundry & Home Care business unit, Henkel now expects organic sales growth of +4.0 to +6.0 percent (previously: +2.0 to +4.0 percent). Adjusted EBIT margin at Group level is expected to remain unchanged in the range of 9.0 to 11.0 percent. For the development of adjusted earnings per preferred share (EPS) at constant exchange rates, Henkel continues to expect a decline in the range of -35 to -15 percent.

Exit of operations in Russia and Belarus in execution

In April 2022, Henkel decided to exit its business activities in Russia and Belarus. Henkel is thoroughly assessing all options and intends to have completed the process by the end of the year.

Group sales and earnings performance in the first half of 2022

At 10,913 million euros, Group sales in the first half of 2022 were +9.9 percent above the prior-year level (Q2: 5,642 million euros, +13.8 percent). Organic sales, which exclude the impact of currency effects and acquisitions/divestments, showed significant growth of +8.9 percent (Q2: +10.9 percent). Acquisitions and divestments had a negative impact of -1.4 percent on sales (Q2: -1.8 percent). Since the beginning of Q2, this includes the effects of the announced exit of operations in Russia and Belarus. Foreign exchange effects increased sales by +2.4 percent (Q2: +4.7 percent). These also include the effects from the application of IAS 29 (Financial Reporting in Hyperinflationary Economies) required for Turkey since the beginning of the reporting period.

Sales growth in the first half of the year was mainly driven by the Adhesive Technologies business unit, which achieved a double-digit organic increase of +12.2 percent. Here, all business areas achieved organic sales growth. The Beauty Care business unit recorded organic sales growth of +0.4 percent in the first half of the year. The Hair Salon business achieved double-digit organic sales growth. By contrast, the consumer business was below the level of the previous year, mainly as a result of the measures announced to improve the portfolio. The Laundry & Home Care business unit achieved a significant organic sales increase of +7.4 percent, driven in particular by double-digit growth in the Laundry business. The Home Care business recorded positive organic sales development in the first half of the year.

In the emerging markets, organic sales grew at a double-digit rate of +12.9 percent (Q2: +14.6 percent). Business in the mature markets showed a very strong organic sales performance of +5.5 percent (Q2: +7.8 percent).

Sales in the first half of the year in Western Europe showed an organic development of +2.2 percent (Q2: +4.8 percent). In Eastern Europe, organic sales growth amounted to +23.2 percent (Q2: +26.3 percent). In Africa/Middle East, organic sales increased by +3.2 percent (Q2: +5.1 percent). Organic sales growth in North America was +9.2 percent (Q2: +11.7 percent). Latin America recorded organic sales growth of +16.9 percent (Q2: +18.5 percent). In the Asia-Pacific region, organic sales increased by +6.1 percent (Q2: +6.9 percent).

Adjusted operating profit (adjusted EBIT) was 1,166 million euros in the first half of the year, compared to 1,430 million euros in the prior-year period. The decline was mainly due to significantly higher prices for direct materials.

Adjusted return on sales (adjusted EBIT margin) decreased from 14.4 percent to 10.7 percent due to significantly higher prices for direct materials.

Adjusted earnings per preferred share were at 1.95 euros in the first half of 2022. At constant exchange rates, this represents a decline of -20.8 percent compared to the prior-year period. The development was also mainly driven by the significant increase in prices for direct materials.

Net working capital increased by 1.6 percentage points to 5.2 percent of sales (prior-year period: 3.6 percent), also impacted by the sharp rise in raw material prices.

Free cash flow of 46 million euros was lower than in the first half of 2021 (471 million euros) due to lower cash flow from operating activities as a result of the lower operating profit and higher net working capital.

As of June 30, 2022, the net financial position amounted to -1,441 million euros (December 31, 2021: -292 million euros). This development also includes expenses of around 430 million euros in the share buyback program launched in February 2022 as well as dividend payments of around 800 million euros in the second quarter.

Business unit performance in the first half of 2022

In the first half of 2022, sales of the Adhesive Technologies business unit increased nominally by +15.0 percent to 5,467 million euros (Q2: 2,836 million euros, +18.5 percent). Organic sales increased by +12.2 percent (Q2: +13.7 percent). This development was driven by all business units and regions. Adjusted operating profit in the first half of 2022 reached 743 million euros, compared to 820 million euros in the prior-year period. At 13.6 percent, adjusted return on sales was 3.7 percentage points below the figure for the first half of 2021, with earnings figures impacted by the significant rise in prices for direct materials.

In the Beauty Care business unit, sales increased organically by +0.4 percent (Q2: +2.1 percent) in the first six months of 2022. In nominal terms, sales rose by +0.2 percent and reached 1,842 million euros (Q2: 950 million euros, +3.9 percent). This growth was primarily driven by the strong performance of the Hair Salon business, which was able to build on its strong performance in the previous year. Consumer business, on the other hand, was below the level of the previous year, mainly due to the implementation of the portfolio improvement measures announced for 2022. Adjusted operating profit reached 169 million euros in the first half of 2022, compared to 183 million euros in the first half of 2021. Adjusted return on sales was 0.8 percentage points below the prior-year level at 9.2 percent, also impacted by higher prices for direct materials.

The Laundry & Home Care business unit achieved a significant organic sales increase of +7.4 percent in the first half of 2022 (Q2: +10.1 percent). Growth was driven in particular by a double-digit increase in sales in the Laundry business. In nominal terms, sales rose by +6.7 percent to 3,494 million euros (Q2: 1,802 million euros, +11.3 percent). Adjusted operating profit was 313 million euros, compared to 490 million euros in the prior-year period. Adjusted return on sales was 9.0 percent, also below the level of the first half of 2021, particularly due to the significant increase in prices for direct materials.

Agenda for Purposeful Growth: good progress

Henkel is pursuing an agenda for purposeful growth and has developed a clear strategic framework for this. Key elements of the strategic framework are a successful portfolio, clear competitive edge in the areas of innovation, sustainability, and digitalization as well as future-ready operating models – based on a strong company culture.

In the first half of 2022, Henkel continued to work consistently on the implementation of its growth agenda and made good progress across all pillars. With merging the Laundry & Home Care and Beauty Care business units into the new Henkel Consumer Brands business unit, Henkel is taking its purposeful growth agenda to the next level. The structure of the new business unit comprises the two global categories Laundry & Home Care and Hair Care, supported by central functions, and four regions. Further categories will be managed under regional control. The first four management levels have now been defined. In Henkel’s largest single market, the USA, the new organization is expected to be fully established already from September onwards.

In the context of the merger of the two consumer businesses and as part of an active portfolio management, businesses and brands accounting for total sales of up to 1 billion euros are currently under review. This includes the divestment or discontinuation of businesses, which do not meet Henkel’s criteria in terms of growth and profitability. In the first half of 2022, Henkel has already made good progress by exiting some non-core businesses in Beauty Care. These are part of the portfolio measures in Beauty Care with a sales volume of around 200 million euros, targeted for execution by the end of the year.

Henkel also further strengthened its portfolio through acquisitions. In July 2022, the acquisition of Shiseido‘s Hair Professional business in the Asia-Pacific region was closed. This has made Henkel the global Co-number 2 in the Hair Professional business.

To strengthen its competitive edge, Henkel focused on further accelerating innovations, boosting sustainability as a differentiating factor, and on increasing value creation for customer and consumers through digitalization.

A key pillar of Henkel’s strategy is a clear differentiation in the market through successful innovations. These supported growth significantly in the first half of the year. In Adhesive Technologies for example, Henkel has developed new fire protection coatings for batteries of electric vehicles. They do not only significantly increase passenger safety but they also enable customers in the automotive industry to achieve cost-effective production. In Beauty Care, Henkel has relaunched its hair care brand Schauma with a redesigned sustainable packaging concept using 50 to 100 percent recycled plastic. In the Laundry & Home Care business unit, double-digit growth and further market share gains were achieved with Persil, supported by the expansion of the sustainable and e-commerce-ready product range.

For a long time, sustainability has been one of Henkel’s greatest strengths. To reflect the growing importance of sustainable management and the rising expectations of customers and society, Henkel has enhanced its long-term sustainability strategy with its new “2030+ Sustainability Ambition Framework”, introduced at the beginning of this year. In addition to existing goals, new long-term ambitions have been set to drive further progress in three dimensions: “Regenerative Planet”, “Thriving Communities” and “Trusted Partner”.

Henkel made further progress in sustainability in the first half of 2022. On the way to achieving the goal of a climate-positive CO2 balance for its production sites by 2030, Henkel has, for example, converted three additional sites in Europe to operate with 100 percent CO2-neutral energy. In addition, Henkel continues to consistently rely on renewable raw materials. Through a partnership with BASF, around 110,000 tons of fossil-based materials are replaced with renewable carbon sources.

Next to innovation and sustainability, Henkel has defined digitalization as a key lever to strengthen its competitiveness. In the first half of the year, the share of sales generated via digital channels grew double-digit, reaching more than 20 percent. Through its e-commerce platform, the Adhesive Technologies business unit achieved double-digit growth in the first half of 2022. The eShop in the Hair Professional business also recorded double-digit growth with an expanded range of brands and products. In addition, Henkel is further expanding its e-commerce-ready offerings in Laundry & Home Care. The new integrated technical platform RAQN contributed to this.

Lean, fast, and future-ready operating models are important elements of Henkel’s strategic framework. Henkel has further expanded the changes launched in 2020: the digital unit Henkel dx has highly efficient structures enabling higher IT project investments at stable costs.

Another key element of the Purposeful Growth Agenda is to further develop Henkel’s corporate culture and accelerate the cultural transformation. The company aims to foster a collaborative culture. In the first half of the year, Henkel continued to launch a range of measures to achieve this goal and further empower its employees.

For example, Henkel launched a comprehensive change management program in connection with the merger of the Laundry & Home Care and Beauty Care business units. The program focuses on change upskilling and team transformation. Additionally, to achieve the goal of gender parity across all management levels by 2025, Henkel has taken further concrete steps and launched initiatives such as the Diversity, Equity & Inclusion Week. As part of the comprehensive Smart Work concept, new initiatives were introduced that focus on the mental health and well-being of employees.

“Although we were confronted with the effects of the COVID pandemic as well as the war in Ukraine, we significantly increased our organic and reported sales in the first half of the year. As expected, our results were impacted above all by the drastic increase in raw material and logistics costs. This is also reflected in our updated outlook for fiscal 2022“, said Carsten Knobel. “We are proud of the good progress we have made in implementing our strategic agenda for purposeful growth and we will continue to consistently pursue our strategy in this overall challenging environment.”

* Adjusted for one-time expenses and income, and for restructuring expenses

This document contains statements referring to future business development, financial performance and other events or developments of future relevance for Henkel that may constitute forward-looking statements. Statements with respect to the future are characterized by the use of words such as expect, intend, plan, anticipate, believe, estimate, and similar terms. Such statements are based on current estimates and assumptions made by the corporate management of Henkel AG & Co. KGaA. These statements are not to be understood as in any way guaranteeing that those expectations will turn out to be accurate. Future performance and results actually achieved by Henkel AG & Co. KGaA and its affiliated companies depend on a number of risks and uncertainties and may therefore differ materially (both positively and negatively) from the forward-looking statements. Many of these factors are outside Henkel’s control and cannot be accurately estimated in advance, such as the future economic environment and the actions of competitors and others involved in the marketplace. Henkel neither plans nor undertakes to update forward-looking statements.

This document includes supplemental financial indicators that are not clearly defined in the applicable financial reporting framework and that are or may be alternative performance measures. These supplemental financial indicators should not be viewed in isolation or as alternatives to measures of Henkel’s net assets and financial position or results of operations as presented in accordance with the applicable financial reporting framework in its Consolidated Financial Statements. Other companies that report or describe similarly titled alternative performance measures may calculate them differently.

This document has been issued for information purposes only and is not intended to constitute an investment advice or an offer to sell, or a solicitation of an offer to buy, any securities.